H.R.-1, the One Big Ugly Bill is now law, despite an overwhelming majority of Americans not being in favor of it before or after its signature (even Fox viewers hate it). Our representative republic is failing us. While Americans may disagree on the priority of our funding, most Americans agree on fiscal responsibility. We cannot keep ballooning our debt on the backs of future generations. Few understand what that really means. You can blame that on a generation who encouraged citizens to take on so much personal debt to satisfy instant gratification that it led to massive amounts of bankruptcy, a once-in-a-lifetime banking crisis, and short-term memory disorder that sees us learning nothing from history to change our behaviors. America’s ability to fund our standard of living historically was borne by a progressive tax on the rich. It helped us win World War II. It built the highways. It sent us to the moon. It built a strong defense AND took care of the least and last of Americans at the same time. And it built an economy that was the envy of the world.

Then we bought into the biggest lie of all: Reagan’s promise that cutting taxes for the rich would trickle down to the rest of us. For 45 years since this claptrap, we’ve seen Republicans go back to that same playbook because it’s sounds good when you say it. (Admit it: Dubya’s tax cuts and Trump’s tax cuts were just a lame remix of Reagan’s original master recording with nothing new or substantive to add to the experience.). Trouble is, nobody looks deeper into the issue, and are quick to damn the whole system based on widely-publicized abuses and breakdowns.

Our budget against our income source was no longer sustainable, and rather than admit the first Bush was right to raise taxes on the rich, we’re left with the only other alternative: cut spending. Who suffers? The least, and last and lost of American society, while the grift goes on. It’s no small irony that the party that claims to be all about Jesus couldn’t be farther from his teachings. I’m not that kind of Christian.

So Congress passed and Trump signed into law a cruel and terrible bill that continues his tax cuts for the rich, increases our deficit $3.8 Trillon, while cutting services for struggling Americans and keeping minimum wage at the same paltry rate of $7.25 per hour that was set by President Obama way back in July 2009. No relief in sight for the hardest-working among us.

As a constituent of VA-1 I am most aggrieved by the gaslighting by our congressional Representative Rob Wittman. A man who most benefited from social services as a child adopted at eight-months old, he continually claims to have “fought to protect and preserve Medicaid for Virginia’s most vulnerable” and yet claims “this bill does just that” despite the analysis of experts who explicitly told him otherwise. I know and have spoken with people who were in the room where it happened. He says one thing, then votes another way … the way his powerful party directs him to vote, robotically, with no conscience of his own. With every vote, Wittman has rushed out press releases and “Correcting the record” email blasts designed to spin and distract from the issues we citizens keep bringing up.

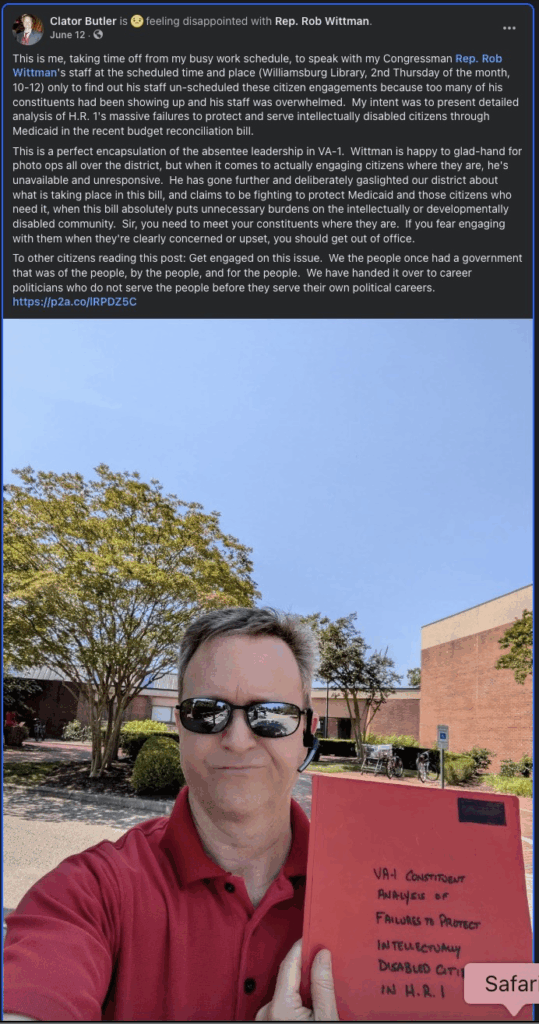

I sent numerous detailed emails to Wittman’s office in advance of this bill’s passage and even went so far as to prep a full report in writing and went to our local library where Wittman had scheduled a recurring bi-weekly meeting with Constituents. NOBODY WAS THERE. The Library staff informed me that because so many constituents were showing up with concerns, Wittman’s office simply cancelled them altogether. Let me yell this point if you’re not getting it yet: TO IGNORE YOUR CONSTITUENCY WHEN THEY NEED YOU MOST IS DERELICTION OF DUTY!

I sent the following letter I sent before the bill passed the House the first time. I doubt his handlers let him read it.

Dear Rep. Wittman,

From your recent email blast justifying your vote on the budget reconciliation bill H.R. 1, you said:

QUESTION: Did the Reconciliation bill cut aid to mothers, children, seniors, and people with disabilities?

ANSWER: Absolutely not. This bill strengthens and secures Medicaid for those who need it most. There are no cuts to Medicaid for mothers, children, people with disabilities, or elderly Americans. Instead, it ensures illegal immigrants, able-bodied adults choosing not to work, and people who aren’t actually qualified for Medicaid aren’t draining the already-burdened system.

Wrong again, sir. The new Medicaid work requirements have put hurdles before the able-bodied-but-intellectually-disabled citizens like my youngest son. Again, for the record, our family traces our roots in this country back to the American Revolution. Multiple generations have served in armed forces or civilian government honorably. My youngest son is a proud American, an Eagle Scout, who possesses an unquenchable thirst for knowledge precisely because his intellectual and developmental disabilities and his Autism rob him of the executive functioning necessary for truly independent living — functioning that neurotypical people like you and me take for granted. He turns 18 next weeks, and is on the cusp of being Medicaid eligibility, programs intended to help him gain some semblance of independence and get supports in place for when his mother and I can no longer help. In your own response above you claim you are saving the burdened taxpayer from “able-bodied adults choosing not to work” which is a hasty generalization of the most callous sort that assumes a human being like my son must be lazy if he cannot find or maintain a job. I’m responding ONE MORE TIME in hopes you pay attention to the legal details, because the text of H.R. 1 for which you voted does NOT protect the intellectually disabled in the manner you claim.

The text of the bill you voted “yes” to, page 378 lines 10-14 defines a “specified excluded individual” thusly: “‘(dd) with a physical, intellectual or developmental disability that significantly impairs their ability to perform 1 or more activities of daily living.“

There is a legal difference between “Activities of Daily Living” (ADLs) and “Instrumental Activities of Daily Living” (IADLs). See attached relevant definitions. Nowhere in H.R. 1 is “Instrumental Activities” even mentioned. While the bill you approved DOES make exceptions for those who are not able-bodied because they lack the ability to independently transfer from bed to chair, bathe, dress, toilet, or feed themselves, the bill does NOT make the necessary “Instrumental Activities” exception for those who can handle the above, but cannot manage their own finances, hold down a job, arrange for groceries and cook for themselves, etc. These abilities most of us take for granted, but many adults with Intellectual or Developmental Disabilities, or those with Autism Spectrum Disorder, rely on the help of society through Medicaid. Our government of the people, by the people and for the people used to understand this and protect these vulnerable citizens. Instead, the new work/volunteer requirements for Medicaid, coupled with the requirement to re-validate regularly one’s disability to the government, will ensure countless thousands of American Citizens like my son are denied the supports they will require to live and be productive members of society.

Congress has become full of people, mostly in your GOP, who see citizens like my son as a drain on the bloated wallets of their donors. With the passage of H.R. 1, we have just taken one step closer to Nazi eugenics programs (read the attached summary from the United States Holocaust Museum). This is not an alarmist statement, this is history repeating itself, on your watch, apparent to all who are paying attention. You have spurned citizens like my son, some of whom vote (until you strip that right too). You’ve just turned away thousands like him in our district to curry favor with the rich and powerful. That is the price of your soul. It will be remembered at the ballot box in November 2026.

I encourage you to re-read Matthew 25:31-46 and understand the price of callous indifference.

I look forward to a proper response (not the usual self-congratulatory press releases) from you that demonstrates you, the elected official responsible for your votes, have actually taken the time to understand the nuances of what you have done and are committed to fixing it. Otherwise I am left to stick with the conclusion that this burden on the diabled is purposeful, that you really do not care for the intellectually disabled citizens of America, and you are willing to mislead your constituents about your actions.

Civically yours,

Clator Butler

VA-1 Voter and Taxpayer

The Senate did nothing to address this concern and passed the bill. The House quickly re-voted on it so they could get on with their 4th of July holiday plans. Trump signed this abomination into law on the 4th, and the founders rolled over in their graves.

Wittman immediately – within minutes of the bill’s final passage — crowed about this thing as good for the country and had the gall to reiterate that he’d protected citizens on Medicaid. I was quick to retort:

Rep. Wittman, YOU FAILED TO PROTECT YOUR VULNERABLE CONSTITUENTS! Your gaslighing does not pave over these facts about the implications of your new law’s negative impacts on Intellectually Disabled AMERICAN CITIZENS.

Excerpts from the final the analysis by The Arc of the United States on how badly the Budget Reconciliation law (one big ugly bill), embraced wholeheartedly by the GOP harms some of the very vulnerable populations you took an oath to protect.

Medicaid

According to the nonpartisan Congressional Budget Office (CBO), the Senate bill cuts Medicaid by nearly $1 trillion, approximately $200 billion more than the House bill. Taking into account that the bill does not extend the ACA enhanced premium tax credits, CBO estimates this bill would lead to nearly 17 million losing health care.

CBO estimates the proposed Medicaid cuts would cost states $200 billion over ten years due to reduced federal funding and restrictions on how states can finance their Medicaid programs. The federal cuts would force state changes including “reducing provider payment rates, reducing the scope or amount of optional services, and reducing Medicaid enrollment.” Of the 7.8 million people CBO expects to lose Medicaid and become uninsured, 2 million would lose coverage because of state responses to increased financial pressure.

Large-scale coverage losses would add other costs to states that CBO’s estimates don’t reflect, including increases in uncompensated care, a sicker workforce, job loss in the health care sector, and loss of tax revenue. These impacts would further burden state budgets, which are already under strain.

Work Requirements

• The mandatory work requirements remain in the Senate bill. These requirements are designed to terminate health care for 5.2 million people. The Senate proposal eliminates exemptions for parents of kids over 14 years of age (instead of all parents) – adding up to 300,000 more people harmed by work requirements.

• New applicants for Medicaid must meet work requirements at the time of application, and states can look back up to 3 months prior.

• The Secretary of Health and Human Services can exempt states from compliance until as late as 2028 if the state is demonstrating a “good faith effort”, leaving work requirements programs largely at the discretion of the Secretary.

• States must require “able-bodied” adults aged 19–64 to work or do approved activities for at least 80 hours a month to qualify for Medicaid. Despite claims to the contrary, many individuals harmed by work requirements will be people with disabilities and older adults between the ages of 50 and 65. Many will be people who are already working, including direct support professionals and home care workers, or people caregiving for people with disabilities.

• Exemptions include individuals who are “medically frail” or otherwise have special medical needs (as defined by the Secretary), including individuals with intellectual or developmental disabilities. Also exempted are individuals during months in which they are served in an intermediate care facility for individuals with intellectual disabilities.

• We also know from past experience that people with intellectual and developmental disabilities can get caught up in red tape and the burden imposed on states to administer these requirements. Many family caregivers who receive Medicaid will be subject to work requirements, making it difficult for them to balance work and caregiving.

• A recent analysis of the enrollees in the Medicaid expansion affected by the new work requirements demonstrates that the vast majority of working-age adults (aged 18-64) are either working, caring for family members, or exempt because of health issues.

• Specifies seasonal workers meet requirements if average monthly income meets specified standard.

• Requires states to use data matching “where possible” to verify whether an individual meets the requirement or qualifies for an exemption (House bill only requires data matching “where possible” for verifying meeting work requirements).

• Provides funding to states for FY 2026 up to $200 million and HHS implementation funding for FY 2026 to $200 million.

• This provision would now take effect sooner (December 31, 2026 instead of 2029) or earlier at state option, increasing coverage losses and adding stress to state systems because of the rushed start. The amended bill mandates guidance for states by December 31, 2025.

• The bill eliminates the discretion of future administrations to waive work requirements for various populations.

Eligibility determinations

• Requires states to conduct costly eligibility redeterminations at least every 6 months for Medicaid expansion adults.

• The Senate added that the Secretary must issue guidance on determinations within 180 days.

• People lose coverage when they miss notifications, steps in the process, or just don’t know that they are up for review. This provision will create gaps in coverage for qualified people and changes the rules that currently require review once a year.

• Senate bill Provides $75 million in implementation funding for FY 2026.

Creation of a federal school voucher program

• The bill creates a new income tax credit for charitable contributions made to scholarship granting organizations (SGOs), that provide scholarships to students to attend private schools.

• Currently, 29 states and the District of Columbia have at least one private school choice program. 15 of these states have at least one program that is universally accessible to all K-12 students in the state. This would be the very first ever federal voucher program.

• The Senate-passed bill amended the text to appease concerns from the parliamentarian.

• The tax credit in the Senate-passed bill is significantly lower (up to $1700 rather than $5000 or 10% of adjusted gross income) and it is only in states that authorize SGOs; many states may not.

• No overall cap on total amount of donations (most recent version was

$4 billion per year); therefore, if this policy changes becomes popular

(i.e. lots of people donate and claim the credit), it could be far more expensive than anticipated and have an (indirect) impact on federal education spending writ large. The unofficial price tag is $26 billion.

• The Senate also added a permit to issue regulations and guidance.

• The House-passed version of this voucher program included language that attempted to protect students with disabilities from discrimination in admission to private schools. The Senate version removed this language.

• Since the money flows to an SGO before going to the private school, it is not considered federal money. This means the schools do not need to abide by the same civil rights laws (including IDEA, Section 504, and the ADA) as public and charter schools.

Ultimately America was failed by partisanship in a real and impactful way. Actual wishes by the majority for budget reconciliation were roundly ignored as Congressional Republicans, fearful of being primaried in 2026, sought to appease a vindictive President and rich donors who fund their campaigns, instead of the citizens who elected them to serve. Remember that elections have consequences, and we must stop sending self-serving politicians to represent the needs of the greater good. They have proven your well being is the last thing they care about.